By

Kristal Advisors

December 22, 2021

The price of gold has remained unusually soft over the past one year, despite central banks expanding their balance sheets in an unprecedented way to combat the COVID-19 crisis.After falling below $1,500 per ounce in March 2020, gold surged above $2,000 just six months later, in August 2020. But another six months later, by March 2021, gold fell to about $1,700. It currently trades a little above $1,800, well below the record high reached last year.So why has gold fallen in an era of monetary expansion, and what lies ahead for the yellow metal?But before that, let’s look at the factors that drive the price of gold.

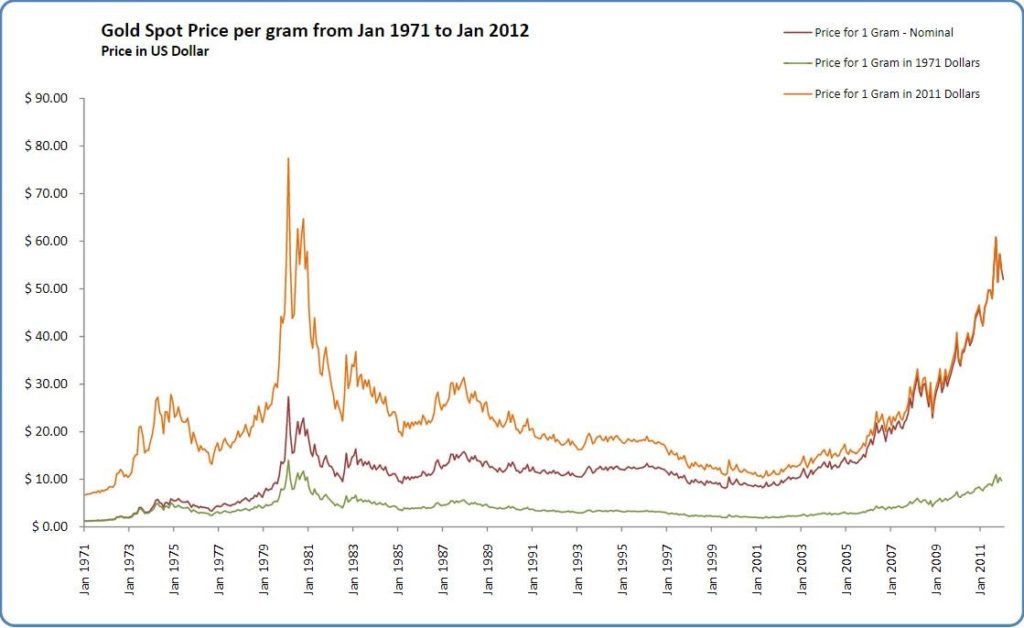

For centuries, gold was used either as an actual currency, or as something that backed paper / fiat currency. (Central banks used to print currency notes only to the extent of the gold they had.)This means that gold has a natural appeal during two situations. First, during times of crises, investors look to buy gold because of its status as a store of value, especially at a time when the purchasing power of fiat currencies is falling.. History shows that gold tends to protect investors during a downturn. Second, gold tends to rise when there is fear of inflation. Inflation typically rises when central banks increase the supply of money in an economy.For instance, take a look at the historical price of gold between 1971 and 2012. (Source of image: Wikimedia Commons)

Gold rose sharply in the late 1970s as the Gulf oil crisis created a global economic and inflation shock. Only a few years back in 1971, President Richard Nixon had abolished the gold standard, which dictated how much currency countries could print. Prices rose from $3 per gram to over $20. But it entered a long-term bear market between 1981 to about 2003. This happened as the US was not only able to tame inflation but also entered an economic boom.Gold finally showed signs of life around 2005 as the global economy began showing signs of overheating. The 2008 crash and the Federal Reserve policy response catapulted the yellow metal in a bull market. In the eight years between 2005 and 2011, gold rose nearly eight times .

As the COVID-19 crash ravaged the global economy, gold started to rise again. But the rally has fizzled out for now. This is partially also the result of the quick recovery that took place in major economies, especially the US.Going forward, experts believe the outlook on gold will be driven by two factors. Firstly, if the Federal Reserve continues to allow inflation to run hot while maintaining a dovish stance relative to market expectations, such an environment can be bullish for gold. As long as inflation remains under check (transitory) and the Fed is not forced to hike faster than what’s priced, this is likely to benefit gold. This still remains our base case.Secondly, gold has been facing some competition from the cryptocurrency complex, that some investors have started calling digital gold. Both gold and bitcoin at least partially compete for similar investments. Hence, a continued rise in the price of cryptocurrencies and greater degree of adoption of crypto as an asset class, could result in gold losing some of its sheen.

Having said that, in the portfolio context, investors should reserve a small allocation forgold (5-15% of capital) as it continues to remain uncorrelated with traditional asset classes and does not have high volatility episodes that are prevalent in cryptocurrencies. As such, we don’t think cryptocurrencies are a replacement for gold yet. During times of stress and in a world where fiat currencies continue to lose value, gold could serve as a reasonably safe place to hide.One of the most popular ways to invest in gold is through liquid ETFs. that track the price of gold or ETFs that invest in gold mining companies. Kristal.AI has even created a ‘Mona Sona’ portfolio with S&P 500 acting as Mona from a famous Bollywood movie. The portfolio offers a lowly correlated portfolio of US equities through the S&P 500, along with exposure to gold.To know about more interesting ideas, please get in touch.

A fully digital onboarding process that can be completed within 15 minutes.

No more voluminous paperwork and queuing!

A fully digital onboarding process that can be completed within 15 minutes.

No more voluminous paperwork and queuing!

I understand the financial products and would want to proceed with investing without a financial guide

Proceed